In the gripping world of cryptocurrencies, ITP Corporation has taken centre stage with its audacious promises. However, as we delve into this ITP Corporation Crypto Review, the façade begins to crack, revealing a story far from the one they paint.

Don’t Be a Victim of the Scam of the Year!

In this exploration of ITP Corporation, we’re peeling back layers to expose the truth. Despite claiming roots dating back to 2013 in Seattle, the narrative surrounding ITP Corp appears to have a much later genesis.

The Enigma of ITP Ownership

Transparency is paramount, yet ITP Corp raises eyebrows with a mysterious lack of information about its leadership. While armed with a Washington registration certificate from November 18th, 2022, the creation of a shell company is not a Herculean task. Moreover, subtle hints in the website code suggest a possible Asian origin.

What’s in the ITP Corporation Crypto Offering?

Unlike legitimate ventures, ITP Corp doesn’t deal in tangible products or services. Instead, they center their operations around the elusive “team members requirement,” focusing on substantial investments and deposits.

The promised returns, ranging from 2.5% to 4% daily, come with a recruitment success requirement. But beware—withdrawal fees lurk based on your investment tier, and retrieving your funds may prove more challenging than expected!

Recruitment Fever in ITP Corporation

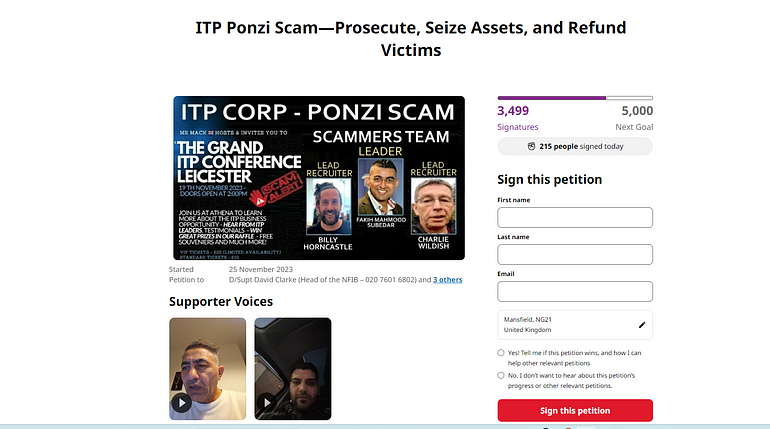

A telltale sign of a Ponzi scheme is the emphasis on recruitment, and ITP Corp doesn’t disappoint. The multi-level referral commission system strongly incentivizes bringing in more investors. However, this structure echoes the classic Ponzi scheme model, where payouts to early participants depend on the funds of newcomers.

Proof lies in the unfortunate reality of countless individuals losing their hard-earned money on the trading app. Just Google it, and the truth unfolds.

Legal Shadows in Our ITP Corporation Crypto Review

No thorough analysis is complete without addressing legal concerns. ITP Corp’s passive investment model demands registration with financial authorities, especially with claims of a U.S. base. Alas, the absence of SEC registration raises the ominous red flag of potential Ponzi scheme operations.

Our Verdict

As we conclude this ITP Corporation Crypto Review, the grand claims of massive profits from ITP Corp seem more like a mirage. The allure of 4% daily returns is a classic bait-and-switch scenario, often indicative of fraudulent schemes.

Key Takeaways from Our ITP Corporation Crypto Review:

- Ownership Ambiguity: Lack of clear information about ITP Corp’s leadership is a concern.

- Ponzi Scheme Indicators: The focus on recruitment and investment tiers aligns with Ponzi scheme characteristics.

- Regulatory Red Flags: Operating without SEC registration is a significant legal risk.

- Unrealistic Promises: High daily returns are often indicative of fraudulent schemes.

Final Thoughts

If you’re contemplating investing in ITP Corp — DON’T!

Our ITP Corporation Crypto Review strongly urges caution. The signs point to a high-risk venture likely to disappoint most participants. Remember, in the investment world, if something sounds too good to be true, it often is. Stay informed, stay cautious, and do your homework before considering any investment. Your financial safety is paramount.